Financial Education

The time it takes to rebuild credit

In this article

- Credit repair and rebuilding can take work but is possible over time.

- There are different factors that influence your credit score like credit utilization and history.

- Debt consolidation and a debt management plan are a couple of ways to rebuild your credit and get back on track.

Repairing your credit takes planning, patience and determination. It won’t happen right away, but if you stay the course, you’ll eventually see a rise in your credit score – which could also raise your spirits.

Financial setbacks can happen to anyone. Whether it’s emergency expenses, missed mortgage payments, compounded credit card interest, bankruptcies or something else, these situations challenge our ability to manage financial stress and can damage our credit.

If your credit score is not as high as you’d like it to be, you’re not alone. Roughly one-third of people in a recent study1 had credit scores lower than 620 (well below the “good” range for the three main credit reporting agencies Equifax, Experian and TransUnion).

Watching your credit score drop can be discouraging. But with some planning and healthy financial habits, it’s possible to restore your changed credit.

How long does it take to rebuild your credit score? There is no definitive answer. The time it takes to repair your credit depends on several factors, including your credit utilization rate and how much debt you have.

Factors That Impact Your Credit Score

Payment history

Missed or late payments will negatively impact your credit. Any charge-off accounts (accounts the lender or creditor has written off as a loss) or bankruptcies also fall into the category of payment history. This category accounts for 35% of your FICO® Score, so it’s an important factor.

Length of credit history

Generally, the longer your established history of having credit, the better. However, having a history of mismanaging credit (such as missed or late payments) can hurt your credit score.

Credit utilization ratio

According to most credit experts,2 your credit utilization ratio should be 30% or less. For example, if you have a credit card with a $5,000 limit, you want to keep the amount of credit you use to 30% or less of that limit, or no more than $1,500. The lower your credit utilization ratio, the better.

Applying for credit

When you apply for a loan or credit card, lenders and creditors will pull your credit report in what’s known as a “hard credit inquiry” or “hard pull.” Each hard inquiry could lower your credit score by a few points and having several in a short period of time could have a bigger negative impact.

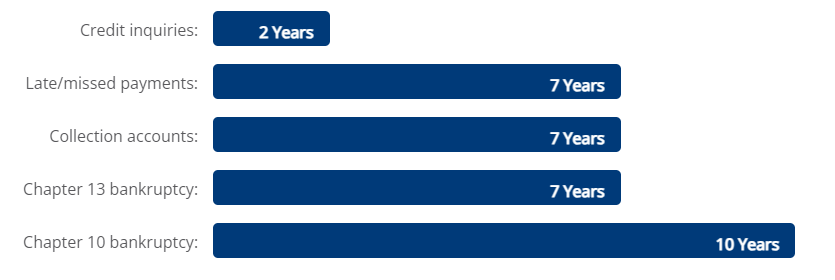

Report Card: How Long Negative Information Stays on Credit Reports3

Since the time it takes to rebuild your credit can vary, it’s a good idea to start now. But how?

4 Steps to Rebuild Your Credit

- Review your credit report. You can get a free copy of your credit report from the three credit reporting agencies – Equifax, Experian and TransUnion – once a year by going to annualcreditreport.com. Knowing how to read and understand your credit report will help set you up for success.

- Get credit counseling. The United States Department of Justice has a list of approved counseling agencies, searchable by state. Most of these credit counseling agencies are nonprofits that provide complimentary counseling.

- Make a budget. Planning your expenses and spending each month can help you stabilize your finances. By starting a budget, you are creating a money management tool and a map to a better financial future.

- Check your budget and credit report regularly. Do financial checkups often to see if your budget needs any adjustment and make sure all the information on your credit reports is still accurate.

Ways to Rebuild Your Credit

- Debt consolidation with a personal loan. Instead of making separate payments to multiple creditors or lenders each month, some people choose to get a personal loan to pay off multiple debts, leaving them with one monthly payment. Sometimes, it’s possible to get an interest rate on a personal loan that’s lower than interest rates on other types of debt, especially credit cards.

- Debt management plan. Typically used primarily for credit card debt, debt management plans are often offered by nonprofit credit counseling agencies. The first step toward getting on a debt management plan is to undergo credit counseling (see step 2 above), and the same agency can usually do both. The benefits of a debt management plan are that it can lower your interest rate and it consolidate multiple debts into a single payment. However, debt management plans usually take three to five years to complete, and you likely won’t qualify for new credit while on the plan. Typically, you can’t use any credit cards that are on the plan, either.

- Use a secured credit card responsibly. Secured credit cards require the user to make a security deposit, and that deposit amount is also the spending limit on the card. If you don’t max out your spending limit and make timely monthly payments, it could gradually help your credit score.

Most importantly, make sure you are paying all your bills on time and paying down credit card debt.

Credit repair takes time. But by understanding the factors that impact your credit score, as well as the steps to take and the tools available to rebuild it, you’ll be on the road to improving your credit in no time.

Related content

Subscribe to our blog

Fill out the form below to sign up for our blog.

Disclosures

1

https://wallethub.com/edu/cs/average-credit-scores/25578

2

https://www.nerdwallet.com/article/finance/30-percent-ideal-credit-utilization-ratio-rule

3

https://www.experian.com/blogs/ask-experian/how-long-does-it-take-to-rebuild-credit/