Financial Education

12 benefits of online and mobile banking

In this article

- Convenience: Online and mobile banking streamline tasks like deposits, bill payments and loan applications to save you time.

- Transaction versatility: Easily manage funds, check balances and handle budgets via other digital payment platforms.

- Enhanced features: Effortlessly track expenses, access e-statements, and manage accounts.

- Don’t sleep on these other tips: Explore other features like setting savings goals and travel alerts.

Got a smartphone and an internet connection? Then you also have a bank in your pocket and a remote control for your money! Today, we can digitally accomplish almost any financial transaction (except getting cash) without visiting a branch.

Though some banks have decreased their number of brick-and-mortar locations and online-only banks have dispensed with them entirely, credit unions like Desert Financial have are happy to help whether you call, click or come in.

Most banks and credit unions offer online and mobile banking that allows you to deposit checks, pay bills and even apply for a loan from your phone. Gone are the days of rushing to the bank before it closes to deposit a check and standing in line for a loan application. And there’s so much more to digital banking that can save you time, help you be more organized and allow you to take control of your finances.

Let’s talk about online and mobile banking

Banks and credit unions have developed the tech savviness to allow you to do pretty much anything virtually and keep your finances safe with enhanced cybersecurity measures. And setting up online banking and connecting to your bank or credit union through your cell phone or computer is easier than ever. It’s no wonder digital banking has become so prevalent in our fast-paced age of instant access, multitasking and monetizing.

Typically, you have to set up online banking before you can log into your financial institution’s mobile banking app, and there are some things that must be done online rather than in an app. For example, at Desert Financial Credit Union, the Bill Pay and budgeting features must be set up through our Online Banking system. Conversely, some things, like remote check deposits, can only be done via our mobile app.

So, how much can you do digitally? Check out these 12 things you can accomplish with online and mobile banking.

1. Create and manage your budget

Think of a budget as a spending plan for your money; a tool that ensures you have enough money for the essentials while helping you stay out of or reduce unhealthy debt. The idea of making and maintaining a budget might seem daunting, but this vital step toward decluttering your finances is easier to take with the help of your bank or credit union’s online budget features.

Just choose the accounts you’ll be making payments to and from, input your monthly income and pick your budget categories (rent, utilities, entertainment, etc.). Many financial institutions allow you to link to other banks or credit unions so you can see all your accounts in one place. After you’ve created your budget, connect transactions as they happen to each item in your budget.

2. Make mobile and direct deposits

Once upon a time in the ‘80s, you would put your paycheck, ID, deposit slip, bank card and other documents in a plastic tube that got pneumatically vacuumed inside a tunnel and delivered to a teller inside the bank. That’s still an option if you’re feeling nostalgic, but if you’re in a hurry, mobile and direct deposits are the way to go.

With direct deposit, your paychecks, government benefits, child support or alimony post to your accounts automatically with no additional action required from you. You can even split up your direct deposits between checking and savings accounts to automate your savings. Mobile deposits have become an easy way to quickly make deposits, with many people simply snapping photos of checks on their cell phone cameras and sparing themselves the time of going to a branch or ATM.

3. Pay bills digitally

You might still receive the occasional birthday check from grandma, but when it comes to your bills, there’s no need for checks anymore (or stamps or envelopes or hoping there are no delays in mail delivery). With your bank’s online bill pay features, you can pay and track your bills without a paper trail.

Set up automatic transfers for recurring payments, make manual one-time payments and set up due-date alerts to help you avoid late fees. You can also set up automatic credit card or loan payments to help pay down your debt faster.

4. Transfer money

Forget spending a ton of time signing a bunch of slips in front of a teller. Moving money between your checking and savings accounts is now as easy as the push of a button or the swipe of a finger.

It’s also fast and easy to transfer money between your accounts or others’ accounts within the same institution or to send or receive money via external accounts if you add them. You can also schedule regular transfers from your checking account into your savings account.

5. Check account, credit card and loan balances

Online and mobile banking apps make it easy to see each of your account balances at a glance. This is especially handy if you’re out and about and find yourself pondering a purchase (can you really afford that new gadget?). Some banks and credit unions even have a nifty feature in their mobile app that shows you your balances immediately with one tap — no need to even sign in first!

6. View statements

Curious to see exactly how much money you deposited last month? Wondering how much interest accrued on your savings? Not sure where you put the inconspicuous white envelope with your bank statement in it? If you’ve already got enough stacks of papers on your desk, you can cut down on the paper piles with online statements. Online and mobile banking gives you instant access to statements as soon as they’re posted, so you can keep better track of your expenses and see what’s happening with your money any time you want.

7. Apply for loans

You don’t have to visit a branch when you need to open a new account or apply for a loan. In fact, you don’t even have to leave home! Some banks and credit unions, including Desert Financial, have online systems for account openings and allow virtual applications for:

- Credit cards

- Mortgage and mortgage refinance

- Home equity lines of credit (HELOCs)

- Auto and RV loans and refinance

- Personal loans (including student loans)

- Small business loans

Applying for a loan online saves paper and time. Many financial institutions will pre-approve you for a loan and let you know if your application was approved fairly quickly. Some banks and credit unions offer low annual percentage rates (APRs) and may even waive application fees for qualified applicants.

8. Open new accounts

Remember when you had to bring two forms of ID, proof of residency and some cash to a physical bank branch to open an account? Well, nobody really has to do that anymore. Checking, savings, money market accounts – no matter what you’re looking to start, you can easily open a new account online in just a few simple steps. It’s quick, advantageous and effortless. No hunting for paper utility bills required.

9. Use payment (P2P) apps

Dining out with a group of friends used to entail all sorts of math and scribbling on napkins to figure out who owed what toward the bill, and then the bill might be split various ways, some of which were a pain for servers (i.e., running different amounts on half a dozen credit cards). Person-to-person apps, sometimes called peer-to-peer apps, make it easy for everyone to pay one individual, who can then pay the bill with their card or cash.

P2P payment platforms like PayPal, Venmo and Zelle make sending or receiving money a breeze. With a few swipes of a finger, you can pay for half of a pizza, buy goods from friends, donate to fundraisers and more. Just enter your debit card, credit card or bank account information in the P2P app to send and receive funds.

10. Use your digital wallet

Your digital wallet is like a virtual version of the old physical wallet but without the wallet-sized school photos of your littlest family members. Typically accessed via payment platforms like Google Pay™, Samsung Pay® or Apple Pay®, your digital wallet contains your debit and credit card information, so you can make purchases without swiping or tapping a card. Going to a movie? Just hold your phone up to the terminal (if there’s a Wi-Fi contactless payment sign on the reader), and voila! Popcorn purchased.

Your digital wallet can also hold things like gift cards, coupons, tickets and boarding passes. It’s not hard to set up and use your digital wallet, and the speed, security and safety it provides is well worth the small effort.

11. Oversee your teen’s or aging parents’ finances

If you have a teenager you’re teaching about money, you can monitor the use of their teen checking account and debit card. (How much did they spend at Forever 21 and H&M?) If you have aging parents, you can also assist them with paying bills or managing their finances if you’re on their accounts.

12. Keep your money safe

Cybersecurity is top of mind for financial institutions, so they use firewalls and encryption to protect their customers’ account information. Most banks and credit unions, including Desert Financial, offer fraud alerts when abnormal charges to your account are detected or if your account is in danger of being overdrawn. You can set email alerts for when your account balance is low, when a deposit has gone through or when a check clears.

But wait, there’s more…

There are many more things you can do with mobile and online banking. Some might surprise you.

- File taxes. If you use the help of an online tax preparer, they can often connect with your financial institution to access documentation. This can save you a lot of time looking for forms, inputting and double-checking information and crunching numbers.

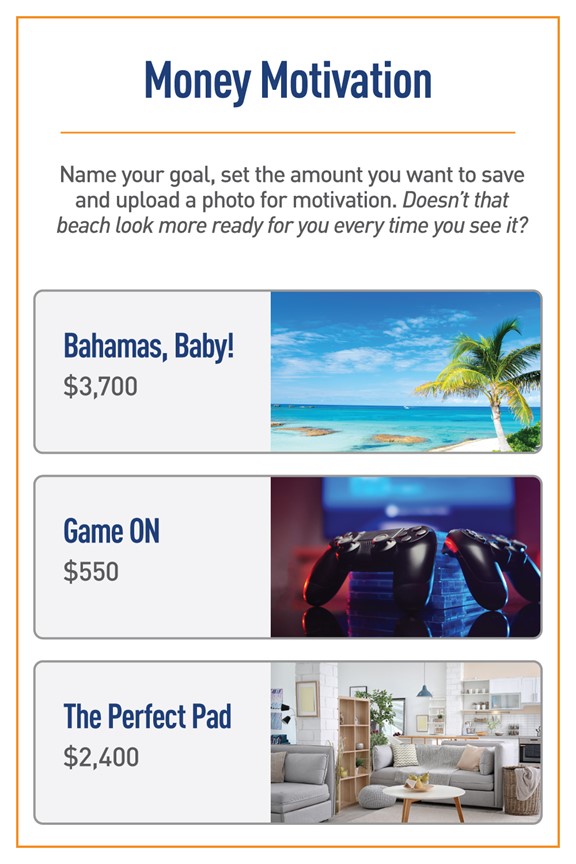

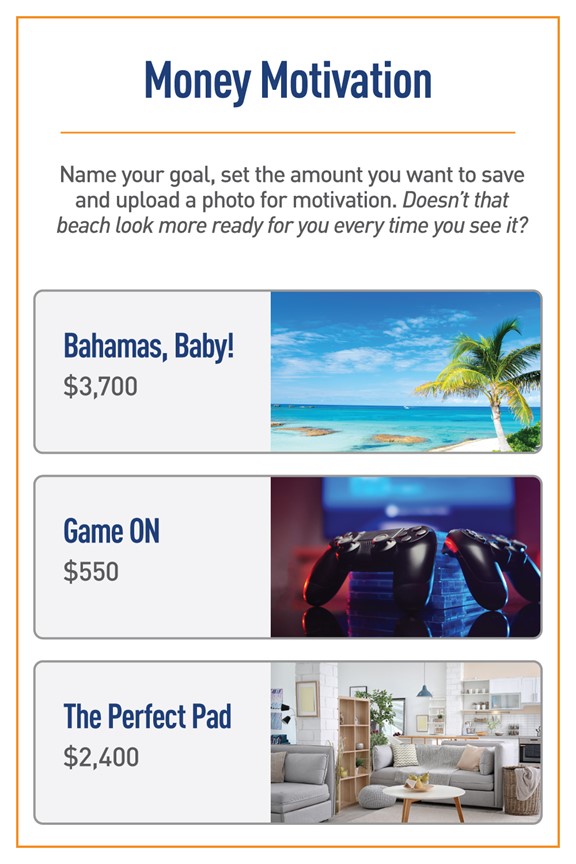

- Track your savings goals. Desert Financial is among the credit unions and banks that offer a feature for you to create savings goals for your accounts online. You can have multiple savings goals, contribute specific amounts to different goals and track your progress online and on your mobile phone.

- Manage investments, with or without the help of a financial advisor. Many banks and credit unions partner with financial advisors and investment specialists and have banking systems that link directly to your investment accounts from your computer or smartphone.

- Manage your Health Savings Account (HSA). If you have a high-deductible insurance plan that qualifies you for a Health Savings Account, you can manage your contributions and track your spending on things like copays and prescriptions.

- Find ATMs closest to you whenever you need cash. Use your financial institution’s website or mobile app to see where the closest branches and network ATMs are. Credit unions often offer free access to a nationwide network of ATMs through the CO-OP ATM Network.

- Set travel notifications. So your bank or credit union knows you’ll be on vacation and won’t flag or freeze your account for transactions made away from home. This can be done online, or from the mobile app on your phone if you forget until you’re sitting at the gate at the airport.

Online and mobile banking is useful for more actions than just checking your account balances. Some are fundamental functions of a bank or credit union, like making deposits and transferring money. But there are many innovations leading the way in the evolution of digital banking, such as multi-factor identification and increased cybersecurity and investment portfolio management.

Take advantage of all the benefits of online and mobile banking to improve your financial well-being and boost your money management skills. It’s as easy as the push of a button or a swipe of your finger!

Related content

Subscribe to our blog

Fill out the form below to sign up for our blog.