Financial Education

How to use digital payments

In this article

- Digital payments make transactions easy and are a simplified form of payment.

- Zelle®, PayPal®, Venmo® and Cash App® are the top four digital payment platforms.

- Zelle® is integrated directly in our app, so you can quickly and easily send and receive money with friends, family and others you trust.¹

- Follow our useful tips to help you be safe when using these forms of digital payment.

Digital payments let people send and receive money electronically. People are increasingly using these platforms because they’re fast, convenient and easy to set up and use. If you’re new to how they work, keep reading to:

- Get to know the big four: Zelle®, PayPal®, Venmo® and Cash App®.

- Learn about important safety and security precautions.

- Understand why you should use debit for your app’s payment method.

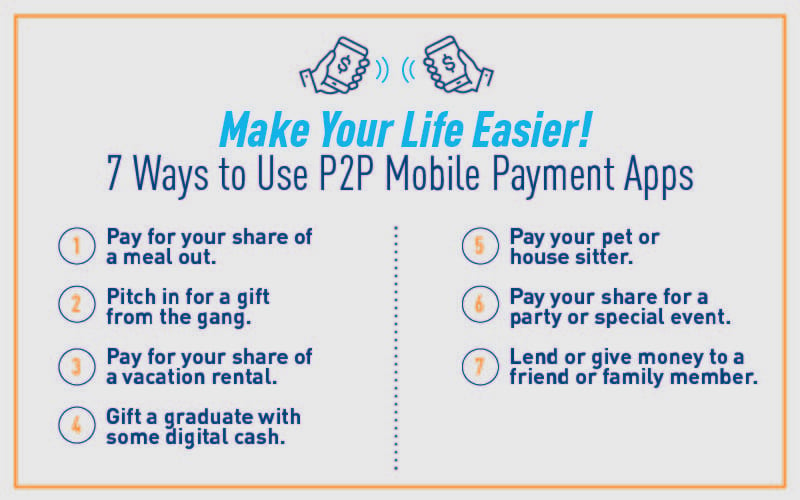

- Check out eight ways to use digital payments to make your life easier.

You’ve been there before — dining out with a large group. It’s a great time until the bill comes, and everyone awkwardly pulls out their wallets. How do you pay?

- Give cash to whoever foots the bill or throw down cash to pay for what you owe.

- Tally up what everyone ordered on the back of the receipt. All parties mark down their total and card number. (The server loves this one.)

- Throw in everyone’s cards and split the bill, which always ends up being unfair to those who skipped drinks and appetizers.

With the emergence of digital payments, these methods are history. Digital payments make it easy to pay back someone for what you owe or request and receive money. Whether it’s your portion for the Airbnb you’re splitting with family, your half of the rent or a reimbursement to a friend for the money you borrowed, it’s easy to send that money. So, what are these digital payment platforms, and how do they work?

Let’s talk about how they work

Sounds easy, huh? Here’s why: Digital payments provide streamlined electronic transactions between people. Enroll and link your bank account, or your debit or credit card, to the platform. Some platforms allow you to use the balance on the app. If you’re an overspender, using debit may be the preferred option for avoiding debt, potential fees and the growing interest that comes with credit.

Depending on the platform, you’ll search for the recipient by phone number, email address, username or even Facebook (if you choose to sync to that social platform). From there, follow the instructions to send money.

Not a user yet? Getting started is also simple! For PayPal®, Venmo® and Cash App®, search for and download the app, sign up for an account and follow the prompts, including any steps for verification and passwords to increase security. If your bank or credit union offers Zelle® to its customers, you can enroll and get started in their app or online banking.

The four most common forms of digital payments

Zelle®, PayPal®, Venmo® and Cash App® are among the platforms. There are several contactless payment apps, but apps like these are less inclusive. The big four are more convenient because they’re more universal. Before sending money, be sure your friend has the same payment app you use or banks with a financial institution that offers Zelle®.

Zelle®

Zelle® is a digital payment service found in most people's banking app that makes sending and receiving money directly between bank accounts fast and easy. Transactions between enrolled users typically occur in minutes. Just make certain your recipient uses a bank or credit union that offers Zelle® before sending them money.

It’s also integrated directly into our mobile app, making it easy to send and receive money in a matter of minutes when both parties are already enrolled.1 Getting started is also simple. Just download our app from the App Store or Google Play and log in to your account. Then, select Zelle® from the menu at the bottom of the screen and enroll with your email address or U.S. mobile number. Then you’ll be set to use Zelle®!

PayPal®

PayPal® arguably reigns as king of P2P payment apps. It dates back to 1998 when it was founded as a money transfer service for online vendors and customers. Known for revolutionizing this type of payment processing, PayPal® was bought by eBay in 2002 and skyrocketed in popularity around the globe as a growing number of people use PayPal® for personal transactions. It’s also a large commerce platform where merchants can do business with customers while managing their cash flow.

Venmo®

This app is so popular that it’s coined the phrase “just Venmo® me!” Not only is PayPal®-owned Venmo a P2P mobile payment app, but it’s also a social network. Send a memo line and emoji with your payment and select Public to enable the feed where everyone can see who’s paying whom for what. Through this broadcast, requesting and sending money becomes a social experience.

Cash App®

Cash App is another P2P mobile platform allowing users to send, receive and bank funds. At the same time, it takes the next step by offering direct deposit and investing. Users can buy and sell stocks, ETFs and select cryptocurrency, or they can access high-yield savings accounts. It puts these tools conveniently at your fingertips, all with the functionality of a P2P payment system.

What about Apple Pay® and Apple Cash®?

Apple Pay® and Apple Cash® can be extremely convenient if your peers have Apple devices because it uses your digital wallet to send money to them. It also allows you to transfer an Apple Cash® balance to your bank account in one to three days.

Another way Apple Cash® sets itself apart is with its ease of use. Just like a debit card or credit card, your Apple Cash® card lives in your digital wallet and can be used to pay at restaurants, grocery stores, convenience stores and more.

Are digital payments safe to use?

Consumer Reports calls these forms of payment “a convenient and easy way to send money to others” but also warns the risks of consumers losing money if they fall victim to scams or sending money to the wrong person.2 That’s why it’s so important to check multiple times to ensure you’re sending your money to the right person when using popular digital payments like Zelle®, PayPal®, Venmo® and Cash App®.

Tips to help you send money safely

- Only send money to someone you know or trust.

- Always double-check the amount being sent before sending. Once sent, you are not guaranteed your money back.

- Beware of common payment scams like romance scams or overpayment scams.

- Use strong and unique passwords for each digital payment platform you use.

- Only use digital payments to send money while connected to a secure network.

Zelle®

With Zelle®, money moves quickly, so you'll want to make sure you’re sending money to someone you trust and that the recipient’s contact information is correct. Zelle® also advises that users be aware of scams and avoid deals that sound too good to be true. For more information on sending money safely, check out www.Zellepay.com/pay-it-safe.

PayPal®

The platform’s robust security features for buyers and sellers can ease user concerns. It helps eliminate any risk by not sharing full financial information with sellers, monitoring transactions 24/7, using encryption technology and offering Purchase Protection.

Security tip: PayPal® will never ask for confidential information via email!

Venmo®

Venmo also uses encryption for account protection, as well as stores information on secure servers and monitors account activity.

Security tip: Venmo® will never contact you to request a password or verification code. Look for “https:” and a lock symbol next to the URL to verify encryption. You can also click on Settings > Security to log out of any devices and add another layer of protection by setting up a PIN.

Cash App®

Cash App® encrypts data and uses fraud detection to protect your money and data, but it’s still a good idea to know how to shield yourself from fraud. Secure your device physically and with a passcode. Also, while you should feel confident using the app, always look out for scams, and be 100% certain about who you’re sending money to.

Keep in mind, like with all financial services, there are risks. Make sure to read up on the precautions your app is taking and only send/receive money with people you know and trust. It is advantageous to use a password generator, change your password frequently and monitor your account.

Millennials are known to have led the mobile payment revolution. As usage rapidly grows, other generations are catching on to it. Are you a newbie to digitally transferring money? Check out the big three mentioned in this article and transform how you share money!

Related content

Subscribe to our blog

Fill out the form below to sign up for our blog.

Disclosures

1

Zelle® is available to active personal online banking users. Waiting periods and additional restrictions may apply. For additional information, please refer to the Zelle® Terms of Service . To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

2

https://www.consumerreports.org/media-room/press-releases/2023/01/consumer-reports-finds-peer-to-peer-payment-apps-offer-ease-and-convenience-but-pose-potential-financial-and-privacy-risks-for-users/

PayPal, Venmo, Zelle, Google Pay, Apple Pay and Facebook Pay are non-affiliated third-parties of Desert Financial Credit Union. Desert Financial makes no warranties or representations about the goods or services offered.