Security

What is a money mule scam?

In this article

- A money mule scam involves exploiting an individual to unknowingly transfer illegally obtained funds

- Recognize red flags: Understand signs of potential money mule requests

- Stay safe: Protect yourself from becoming a victim of money mule scams

Imagine unknowingly participating in a scam without realizing that you’re the perpetrator involved in fraud. In this scam, you’re the money mule. A money mule is someone who transfers money or items on behalf of someone else (the scammer). The criminal baits the target by offering an employment opportunity or by initiating a fake online romantic relationship, for example. Next, they’re instructed to deposit illegally acquired funds into their account and then send the money elsewhere, while “earning a commission.” Promising a portion of the funds as compensation helps persuade the unsuspecting victim into taking part in the fraud.

The importance of understanding money mule scams

Keep in mind, there are serious consequences if you’re a money mule (aside from the threat of identity theft, monetary theft and personal financial damage). Transferring stolen money is illegal, so getting involved in a money mule scam, whether you’re aware or not, is punishable and against the law. Potential federal charges include mail fraud, wire fraud, bank fraud, money laundering and aggravated identity theft. The victim could potentially be held responsible for the stolen money. To avoid getting entangled in money mule fraud, keep reading to learn more about the various ways this scam can play out.

What a money mule scam looks like

The ultimate goal of the criminals is to manipulate a potential mule into becoming a liaison for distributing funds. The criminal instructs the victim to cash/deposit a check or deposit funds given to them into their account. Instructions will further ask the mule to send the funds to a third party or use the funds to buy gift cards or items, and send those gift cards or items to again, a third party. By taking advantage of the mule, criminals can avoid a paper trail with their name, hide their identity and bypass security measures of working with a financial institution directly.

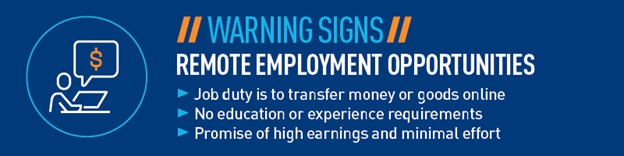

Remote employment opportunities

One of the most common money mule tactics is to hook a target by advertising fake online work-from-home job openings. Positions like “money transfer agent,” “payment processor agent,” “secret shopper” or “mystery shopper” are dead giveaways. In one scenario, you may be hired to start a business and open a business banking account. The job entails receiving a litany of deposits and wiring the money to a “client” or “supplier.”

Security Intelligence, a site invested in cybersecurity analysis and insight, explains that the job of a secret-shopper mule is to evaluate a money-service business by cashing a counterfeit check and using the service to send the funds to another account. Shoppers earn money and share the quality of service with the fraudster. Another version is assigning the mule the task of shopping at a store to evaluate their customer service. They forward the purchases to the scammer and keep a few for themselves as compensation.

Online romantic relationships

Money mule victims are often targeted on dating sites and apps. The scammer deceptively starts a relationship with the mule to build trust and gain affection. Often the scammer resides in a different country. The relationship can go on for months, even up to a year, to form a bond. Eventually, the scammer starts to solicit the victim’s help in receiving and transferring money for reasons such as these:

- They need money to pay for an emergency or a loved one’s illness.

- They need a package to be sent to someone (which could be illegal drugs or a large sum of stolen money).

- They need cashier checks sent to a fake charity.

- They’re military service members who need help accessing funds overseas.

Overpayment scams

The Identity Theft Resource Center warns that overpayment scams are another variation of a money mule scam.1 An overpayment scam involves a con artist who overpays you and then asks for a portion of the funds to be sent back. For instance, if you’re an online merchant and the buyer overpays for the purchase, they may ask you to use the extra money for shipping or fees and then return the remaining. Or, if you’re involved in a work-from-home ploy, you may be overcompensated by mistake and asked to return the extra amount.

You’ll lose money if you’re tricked into an overpayment scam, but worse — you could get into legal trouble. Here’s why: If the money paid to you was stolen, and you accepted and deposited the money and refunded a portion of it from your own account, then you could be held liable for “possession of stolen money” and “money laundering,” warns the Identity Theft Resource Center.1

The biggest tip to remember is never to accept money from someone you don’t know, trust or have met before — and never forward that money elsewhere on behalf of that person. Anytime you’re asked to be the middleman for a transaction, there’s a chance you’re the money mule who’s dangerously handling stolen money. And as always, never give out your personal information and financial details.

If you’re recruited to conduct financial transactions at the direction of someone else, stop communication and any activity you may be involved in. You’ll want to collect any documentation, communication or contact information. Next, notify your financial institution, the wire transfer or gift card companies involved. Lastly, report the scam and suspicious activity to local law enforcement or submit a report to the FTC.

Related content

Subscribe to our blog

Fill out the form below to sign up for our blog.